((The following article is a translation of my August 16 post on Piracy and Microsoft, found here. I re-wrote it in Simplified Chinese for more general dispersal. ))

by Tyler Rooker -- re-written in Chinese

在 中关村,“中国硅谷”,Windows XP的盗版到处都有。这是谁都知道的。不管是农村来到电子城门外的流动人口,还是在柜台装机的人,许多人都不花钱用XP。什么原因啊?价格。正版 Windows要两千多元(250美元)。盗版只需要6元。但是,这样的情况到底损害还是支持微软的操作系统的垄断?

“枪打出头鸟”是中 文的一句俗语。对百度,用友,联想等大公司来讲如果它们用盗版,就会引起微软在法院里的“枪”。但是,对微软来讲,枪打那些今天在明天不在的流动人口,这 么做有什么好处呢?没有。这些流动人口只会被政府的工商部门抓了,罚款,然后遣送回家。而这些被罚的款都属于北京市的政府。那么,盗版怎么帮助微软呢?

从 一个观点来看,答案是,只要盗版在中国继续存在,微软就可以维持它在中国的垄断。现在中国没有操作系统。连计划中的系统都没有。为什么?因为一出来,也会 被盗版。盗版削弱微软,但是同时也削弱中国想要开发自己的操作系统的企业家们。如果中国操作系统是200元(25美元)的话,就可以让那些企业家们获得足 够的利润和投资收益。那样一来,为什么金山(中国的微软)不去开发呢?盗版。

在中国,盗版确实把微软的一部分利润窃取掉。但我想强调是,微软也是从盗版行为获得某些好处和利润。如果没有盗版的话,中国的操作系统就会像毛主席所说的“百花齐放,百家争鸣”。最终,那些系统会削弱或结束微软的操作系统的垄断。

下次微软抱怨中国的盗版时,注意他们找什么理由。在中关村4/5的电脑是品牌机,用的都是正版。1/5是DIY装机的,用的是盗版。那么,微软丢失了还是获得了利润呢?

This blog is an attempt to discuss Zhongguancun, known to some as China's Silicon Valley. Important issues are economic development, technology, history, and culture of this area of Beijing, China. And also, economic and political issues of everyday life in Shanghai and China's cities.

Thursday, November 03, 2005

Tuesday, November 01, 2005

Wikipedia Zhongguancun Entry Updated

I have added some information to the Wikipedia entry for Zhongguancun. It is currently listed under "Zhong Guan Cun," which makes sense because the characters in the Chinese name are three separate ones (see title of this blog).

The current address is:

Wikipedia Zhongguancun

Check it out.

Also, writing up a general introduction to Zhongguancun has made me recall my interview with Chen Chunxian, the China Academy of Sciences (CAS) member who was the first person to think of a Silicon Valley in China. Chen Chunxian was a plasma physicist at CAS until he quit to start a company. He is known in Zhongguancun as "the first person to eat crab" (第一吃螃蟹的人), meaning that dared to try something that looked horrible on the outside but is great once you try it. He passed away one year ago. I will post a future blog about him and his courageous work to set up a company and transfer scientific results into technology that could be used. He really is some one who should be remembered.

The current address is:

Wikipedia Zhongguancun

Check it out.

Also, writing up a general introduction to Zhongguancun has made me recall my interview with Chen Chunxian, the China Academy of Sciences (CAS) member who was the first person to think of a Silicon Valley in China. Chen Chunxian was a plasma physicist at CAS until he quit to start a company. He is known in Zhongguancun as "the first person to eat crab" (第一吃螃蟹的人), meaning that dared to try something that looked horrible on the outside but is great once you try it. He passed away one year ago. I will post a future blog about him and his courageous work to set up a company and transfer scientific results into technology that could be used. He really is some one who should be remembered.

Sunday, October 30, 2005

Zhongguancun is the "China Valley"

With the increasing influence of China -- as global partner or global threat -- Zhongguancun, the Silicon Valley of China, will continue to attract attention from the West. In this vein, I propose that Zhongguancun be known in English as "China Valley" to attest to both its China origin and its purported affinity with Silicon Valley, California.

In the Bay Area and environs, along with those who claim to be insiders to it, Silicon Valley is known as the "Valley". Therefore the nickname given to the China Valley should come naturally.

In addition, this should remove the difficult surrounding the pronunciation of Zhongguancun -- Zhong, guan, cun -- which is quite diffiult for Westerners, and the awkwardness of ZGC, an acronym. "The Silicon Valley of China" works well as a name, but it is too wordy to use in ordinary conversation.

I would be curious as to opinions on this name. It seems to work well. Let me know your ideas.

In the Bay Area and environs, along with those who claim to be insiders to it, Silicon Valley is known as the "Valley". Therefore the nickname given to the China Valley should come naturally.

In addition, this should remove the difficult surrounding the pronunciation of Zhongguancun -- Zhong, guan, cun -- which is quite diffiult for Westerners, and the awkwardness of ZGC, an acronym. "The Silicon Valley of China" works well as a name, but it is too wordy to use in ordinary conversation.

I would be curious as to opinions on this name. It seems to work well. Let me know your ideas.

Thursday, October 20, 2005

Problem Solving

Over the course of 2 years doing research on the Silicon Valley of China, I encountered numerous problems that required skill, perseverance, networking, and creativity to solve. The difficulties ranged from mundane?finding a university and professor to sponsor my research?to the cultural?convincing top executives at Beijing UFSoft Software Corporation that I could conduct objective research on their company operations. There were several different skill sets that I drew on to solve these problems. Besides my knowledge of Chinese culture and language, I sized up the situations, networked with relevant people, and persevered in accomplishing my goals to solve these problems.

To conduct research in Chinese companies is no simple feat. The first step was to obtain a Chinese visa for one year at a university in order to gain sponsorship both for the visa process and for future inquires into my research goals. Using leads from my research committee, I contact two Peking University professors. I also renewed a connection with the Peking University Mandarin Center, where I undergone advanced language training two years pervious. I arranged for one of the professors to write a sponsoring letter which I had delivered to the Mandarin Center. In two weeks, using money I had sent with application, an express letter containing my visa documents arrived. Facing the initial problems of visa and sponsorship, I moved quickly and arranged to have necessary documents delivered and a enrollment letter at Peking University prepared in a total time of less than one month. I was on my way to Beijing to study companies in the Silicon Valley of China.

Two of the three companies were relatively small, with less than ten people. In those two cases, access was not a problem since no proprietary technology or influential information was at stake. Despite this fact, two problems arose: one was how I would introduce myself to these companies; two was how I would explain my research so that I could both gain necessary access to managers and workers and guarantee the participants not to violate their rights as human subjects. I relied on an old friend to introduce me to companies that he knew beforehand. This method guaranteed a minimum of trust, which I subsequently used to explain my research project on the successes of China’s Silicon Valley, a patriotic thing for people in China. This cast my research in a positive light, which facilitated access to managers and workers, as well as revealing the nature of my research that protected individual’s rights of whether or not to participate.

Finally, the biggest challenge I faced in my research was how to get access to a large, prestigious company. I spent one month contacting friends, advisors, and government officials I knew to help me. On a hunch, I emailed to head of Beijing UFSoft for an interview. After the interview, over diner, I mentioned that I needed on the ground information about a large company in China. The executive suggested that I work at UFSoft. This was the opportunity I had hoped for but, knowing how China business and culture work, I could not suggest it myself. I allowed the executive to think that it was he who had thought of the idea. My initiative in setting up the interview, calling on friends to guarantee my character, as well as understanding Chinese culture and this executive’s personality lead to a solution and my access to UFSoft for research. I accomplished my goals through initiative, skill, networking and perseverance that are reflected most poignantly in this example.

To conduct research in Chinese companies is no simple feat. The first step was to obtain a Chinese visa for one year at a university in order to gain sponsorship both for the visa process and for future inquires into my research goals. Using leads from my research committee, I contact two Peking University professors. I also renewed a connection with the Peking University Mandarin Center, where I undergone advanced language training two years pervious. I arranged for one of the professors to write a sponsoring letter which I had delivered to the Mandarin Center. In two weeks, using money I had sent with application, an express letter containing my visa documents arrived. Facing the initial problems of visa and sponsorship, I moved quickly and arranged to have necessary documents delivered and a enrollment letter at Peking University prepared in a total time of less than one month. I was on my way to Beijing to study companies in the Silicon Valley of China.

Two of the three companies were relatively small, with less than ten people. In those two cases, access was not a problem since no proprietary technology or influential information was at stake. Despite this fact, two problems arose: one was how I would introduce myself to these companies; two was how I would explain my research so that I could both gain necessary access to managers and workers and guarantee the participants not to violate their rights as human subjects. I relied on an old friend to introduce me to companies that he knew beforehand. This method guaranteed a minimum of trust, which I subsequently used to explain my research project on the successes of China’s Silicon Valley, a patriotic thing for people in China. This cast my research in a positive light, which facilitated access to managers and workers, as well as revealing the nature of my research that protected individual’s rights of whether or not to participate.

Finally, the biggest challenge I faced in my research was how to get access to a large, prestigious company. I spent one month contacting friends, advisors, and government officials I knew to help me. On a hunch, I emailed to head of Beijing UFSoft for an interview. After the interview, over diner, I mentioned that I needed on the ground information about a large company in China. The executive suggested that I work at UFSoft. This was the opportunity I had hoped for but, knowing how China business and culture work, I could not suggest it myself. I allowed the executive to think that it was he who had thought of the idea. My initiative in setting up the interview, calling on friends to guarantee my character, as well as understanding Chinese culture and this executive’s personality lead to a solution and my access to UFSoft for research. I accomplished my goals through initiative, skill, networking and perseverance that are reflected most poignantly in this example.

Interpersonal Skills

There is one particular time person in particular, the first six months of 2004, when my interpersonal skills were tested and displayed to the extreme. During this period, I spent half a year amongst the migrants and would-be entrepreneurs who work in the IT/electronics markets of Zhongguancun, the Silicon Valley of China. These women and men are not the lofty paragon of technology virtuosity that China’s Silicon Valley is meant to contain. Instead, they are an eclectic population, coming from all corners of China with education ranging from middle school drop-out to technical community college graduate. Living and working amongst them, I experienced tests of my ideas of privacy, rudeness, hygiene. My responses, from anger and frustration to compassion and understanding, reveal the greatest extent to which my interpersonal skills can be stretched.

Experiencing IT/electronics markets for the first, one sees chaos. Boxes seem to move up and down the crowded aisles by themselves, while people spit, smoke, and throw trash outside their stores, regardless of who may be outside or walking by. But even more poignant for an American are people’s eyes. Glances become stares and shopping for a new printer is more like being an animal in a mobile zoo. Hearing only “ha-lou!” (the Chinese transliteration of hello), one quickly tires of these markets.

But I wanted to understand the mixture of technology and business in China. So, on a daily basis, I came to the markets, meeting people store after store, who constantly drew attention to my appearance, my race, and my nationality. In turn, I emphasized politeness. I observed every courtesy and custom that I knew of. Some one once joked with me that I was “more Chinese than the Chinese.” The manners I displayed had been honed over previous years of experience with China.

Store by store and counter by counter, I used my difference to create similarity. Slowly, a group of regular store owners, colleagues, and even friends emerged against the backdrop of chaos and stares. Addressing elder migrants as “big brother,” adopting Chinese mannerisms and postures, and generally being sympathetic to their opinions (at least initially), I was able to enter circles that exist in the IT/electronics markets.

What is even more significance, however, is that I gained an audience. While I learned about China’s technology migrants and emergent market economy, I also was able to speak to a receptive and interested audience about the reasons for the Iraq war, the meaning of human rights, and how unions are formed. Had I not gained trust and feelings of commonality, I be ignored and dismissed. Instead, open dialogue and thoughtful discussion took place as a result of adapting to behaviors, customs, and forms of address that made the IT/electronics migrants of the Silicon Valley of China comfortable.

Experiencing IT/electronics markets for the first, one sees chaos. Boxes seem to move up and down the crowded aisles by themselves, while people spit, smoke, and throw trash outside their stores, regardless of who may be outside or walking by. But even more poignant for an American are people’s eyes. Glances become stares and shopping for a new printer is more like being an animal in a mobile zoo. Hearing only “ha-lou!” (the Chinese transliteration of hello), one quickly tires of these markets.

But I wanted to understand the mixture of technology and business in China. So, on a daily basis, I came to the markets, meeting people store after store, who constantly drew attention to my appearance, my race, and my nationality. In turn, I emphasized politeness. I observed every courtesy and custom that I knew of. Some one once joked with me that I was “more Chinese than the Chinese.” The manners I displayed had been honed over previous years of experience with China.

Store by store and counter by counter, I used my difference to create similarity. Slowly, a group of regular store owners, colleagues, and even friends emerged against the backdrop of chaos and stares. Addressing elder migrants as “big brother,” adopting Chinese mannerisms and postures, and generally being sympathetic to their opinions (at least initially), I was able to enter circles that exist in the IT/electronics markets.

What is even more significance, however, is that I gained an audience. While I learned about China’s technology migrants and emergent market economy, I also was able to speak to a receptive and interested audience about the reasons for the Iraq war, the meaning of human rights, and how unions are formed. Had I not gained trust and feelings of commonality, I be ignored and dismissed. Instead, open dialogue and thoughtful discussion took place as a result of adapting to behaviors, customs, and forms of address that made the IT/electronics migrants of the Silicon Valley of China comfortable.

Sunday, September 18, 2005

Science City Plans Approved

Beijing City Land Plans Approved

Zhongguancun “Science City” Demarcated

August 24, 2005 on http://house.tom.com

Source: Beijing Business Today (http://www.bjbusiness.com)

Original website in Chinese: http://house.news.tom.com/1056/2005824-45625.html

Translated by Tyler Rooker on September 18, 2005 for http://chinasilicon.blogspot.com

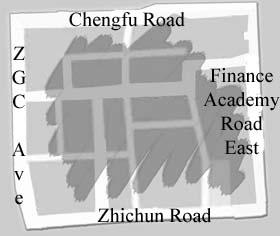

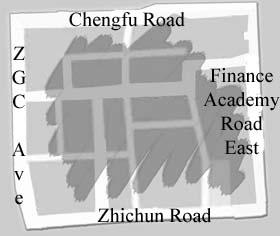

Sketch of “Science City” in Zhongguancun by Zhao Zhenchao

This reporter learned yesterday from the Beijing City Planning Committee that the specific plans for Zhongguancun Science City had been approved. The vice-president of the company responsible for first level developing of the Science City, Yang Jianping of Zhongguancun Science City Construction Limited Liability Company, said: the specific plans were put in place in order to increase benefits from development.

According to the City Planning Committee, the Zhongguancun Science City will run from Chengfu Road in the north to Zhichun Road in the south; from Zhongguancun Avenue (Baiyi Road) in the west to Finance & Economics Academy Road East in the east. This is a total of 331.43 hectares of total land use. The planned total construction is 4.42 million square meters, of which 2.65 million square meters will be set aside for construction by China Academy of Sciences. Insiders pointed out that this is possibly the largest scale land use in a city ever.

The Planning Committee also emphasized that it must combine demands for city landscape, environment, and land development so that multiple levels of construction involved in the Zhongguancun Science City are addressed. Also, it must clarify the plans for a green land system in the Zhongguancun Science City, plans for road and traffic systems, and plans for public facilities and government offices.

The Area is Equivalent to 1.5 Summer Palaces

(See here for an English tour of Beijing’s Summer Palace)

Zhongguancun Science City is located along the development axis of the Zhongguancun Science & Technology Zone. It has an area of over 330 hectares, equivalent to the area of 1.5 Summer Places. Together with Peking University, Tsinghua University and the Zhongguancun western high-tech commercial center, it forms the Zhongguancun Science & Technology Zone, Haidian Park central region. Zhongguancun There are over 25 national research institutes and over 50 national keystone laboratories and development laboratories. There are 16,000 science and technology workers of whom there are over 100 from the two Academies of Sciences. The Science City of Zhongguancun also has a large number of competitive high-tech enterprises. You could say that Zhongguancun Science City is the national treasure of high-tech talent in China.

Tardiness in Constructing the Science City

This reporter learned from related departments that as early as 6 years ago, China Academy of Sciences (CAS) had made plans to construct the largest science city in all of East Asia. In 1999, the city of Beijing and other science and technology departments decided to use a period of 10 years to build Zhongguancun Science City into a world-class science and technology zone.

In 2001, the city of Beijing government and CAS joined hands to plan the science city. In that year, on November 8, the Beijing Zhongguancun Science City Construction Limited Liability Company was formally established, which showed that the Zhongguancun Science City had entered the practical phase. And yet, over three years have passed and construction on the Science City remains in initial stages. Up until yesterday, formal permission to go ahead with the plans by the City Planning Committee had not been given.

The vice-president of the Beijing Zhongguancun Science City Construction Limited Liability Company, Yang Jianping analyzed the situation. He said that the tardiness of construction had three aspects. First, this area totals 331.43 hectares, equivalent to 1.5 Summer Palaces, and so there are difficulties in development. Second, the structure of Zone construction is complex ? the Science City encompasses 25 national research institutes and over 50 national keystone laboratories and development laboratories. These cannot be demolished so demolishment must be carried out carefully to avoid damage. Finally, there have been other problems with demolition that have not been solved.

The Rise of a High-Tech Economic Center

With the issuing of specific plans for the Science City, clear progress has been made in developing it. Specific plans have been integrated with overall city planning and specific district planning. Land use and use intensity in the specific districts has been clarified, while roads and engineering angles as well as environment protection have been integrated. These plans are the direct result of management by the City Planning Committee.

The Beijing Zhongguancun Science City Construction Limited Liability Company vice-president, Yang Jianping, explained it this way: the specific plans have been issues to demarcate the basic height, area, and roads to be encompasses. This is the backdrop to the next stage in planning.

The Beijing Zhongguancun Science City Construction Limited Liability Company has taken on the responsibility of constructing the Zhongguancun Science City High-Tech Industry Innovation Incubator. Starting with land development in 2001, today it has basically completed organization of this land. The Zhongguancun Science City High-Tech Industry Innovation Incubator will take up 33.6 hectares, with the basic function of transferring the scientific research capabilities of the Science City into industrial capabilities. It will become a well-know collaboration and information exchange center domestically and internationally. The Innovation Incubator will also be a high-tech and product training center. According to the plans, within 5-7 years, the Innovation Incubator will take advantage of a perfected infrastructure construction, advanced information networks, lively enterprises, beautiful environment, dense cultural atmosphere, and a modern feel -- a world-class science and technology zone.

President of China area for the Kotler Marketing Company (USA) Tiger Cao, real-estate investment consultant, said in an interview that: “This region has great development future. It will become concentrated area of high- and medium-level income groups. At the same time, because of Zhongguancun’s attractiveness, it will create a large movement of people. Over the next few years, this place will become like the CBD District -- an economic center with high-tech as its focus.

Zhongguancun “Science City” Demarcated

August 24, 2005 on http://house.tom.com

Source: Beijing Business Today (http://www.bjbusiness.com)

Original website in Chinese: http://house.news.tom.com/1056/2005824-45625.html

Translated by Tyler Rooker on September 18, 2005 for http://chinasilicon.blogspot.com

Sketch of “Science City” in Zhongguancun by Zhao Zhenchao

This reporter learned yesterday from the Beijing City Planning Committee that the specific plans for Zhongguancun Science City had been approved. The vice-president of the company responsible for first level developing of the Science City, Yang Jianping of Zhongguancun Science City Construction Limited Liability Company, said: the specific plans were put in place in order to increase benefits from development.

According to the City Planning Committee, the Zhongguancun Science City will run from Chengfu Road in the north to Zhichun Road in the south; from Zhongguancun Avenue (Baiyi Road) in the west to Finance & Economics Academy Road East in the east. This is a total of 331.43 hectares of total land use. The planned total construction is 4.42 million square meters, of which 2.65 million square meters will be set aside for construction by China Academy of Sciences. Insiders pointed out that this is possibly the largest scale land use in a city ever.

The Planning Committee also emphasized that it must combine demands for city landscape, environment, and land development so that multiple levels of construction involved in the Zhongguancun Science City are addressed. Also, it must clarify the plans for a green land system in the Zhongguancun Science City, plans for road and traffic systems, and plans for public facilities and government offices.

The Area is Equivalent to 1.5 Summer Palaces

(See here for an English tour of Beijing’s Summer Palace)

Zhongguancun Science City is located along the development axis of the Zhongguancun Science & Technology Zone. It has an area of over 330 hectares, equivalent to the area of 1.5 Summer Places. Together with Peking University, Tsinghua University and the Zhongguancun western high-tech commercial center, it forms the Zhongguancun Science & Technology Zone, Haidian Park central region. Zhongguancun There are over 25 national research institutes and over 50 national keystone laboratories and development laboratories. There are 16,000 science and technology workers of whom there are over 100 from the two Academies of Sciences. The Science City of Zhongguancun also has a large number of competitive high-tech enterprises. You could say that Zhongguancun Science City is the national treasure of high-tech talent in China.

Tardiness in Constructing the Science City

This reporter learned from related departments that as early as 6 years ago, China Academy of Sciences (CAS) had made plans to construct the largest science city in all of East Asia. In 1999, the city of Beijing and other science and technology departments decided to use a period of 10 years to build Zhongguancun Science City into a world-class science and technology zone.

In 2001, the city of Beijing government and CAS joined hands to plan the science city. In that year, on November 8, the Beijing Zhongguancun Science City Construction Limited Liability Company was formally established, which showed that the Zhongguancun Science City had entered the practical phase. And yet, over three years have passed and construction on the Science City remains in initial stages. Up until yesterday, formal permission to go ahead with the plans by the City Planning Committee had not been given.

The vice-president of the Beijing Zhongguancun Science City Construction Limited Liability Company, Yang Jianping analyzed the situation. He said that the tardiness of construction had three aspects. First, this area totals 331.43 hectares, equivalent to 1.5 Summer Palaces, and so there are difficulties in development. Second, the structure of Zone construction is complex ? the Science City encompasses 25 national research institutes and over 50 national keystone laboratories and development laboratories. These cannot be demolished so demolishment must be carried out carefully to avoid damage. Finally, there have been other problems with demolition that have not been solved.

The Rise of a High-Tech Economic Center

With the issuing of specific plans for the Science City, clear progress has been made in developing it. Specific plans have been integrated with overall city planning and specific district planning. Land use and use intensity in the specific districts has been clarified, while roads and engineering angles as well as environment protection have been integrated. These plans are the direct result of management by the City Planning Committee.

The Beijing Zhongguancun Science City Construction Limited Liability Company vice-president, Yang Jianping, explained it this way: the specific plans have been issues to demarcate the basic height, area, and roads to be encompasses. This is the backdrop to the next stage in planning.

The Beijing Zhongguancun Science City Construction Limited Liability Company has taken on the responsibility of constructing the Zhongguancun Science City High-Tech Industry Innovation Incubator. Starting with land development in 2001, today it has basically completed organization of this land. The Zhongguancun Science City High-Tech Industry Innovation Incubator will take up 33.6 hectares, with the basic function of transferring the scientific research capabilities of the Science City into industrial capabilities. It will become a well-know collaboration and information exchange center domestically and internationally. The Innovation Incubator will also be a high-tech and product training center. According to the plans, within 5-7 years, the Innovation Incubator will take advantage of a perfected infrastructure construction, advanced information networks, lively enterprises, beautiful environment, dense cultural atmosphere, and a modern feel -- a world-class science and technology zone.

President of China area for the Kotler Marketing Company (USA) Tiger Cao, real-estate investment consultant, said in an interview that: “This region has great development future. It will become concentrated area of high- and medium-level income groups. At the same time, because of Zhongguancun’s attractiveness, it will create a large movement of people. Over the next few years, this place will become like the CBD District -- an economic center with high-tech as its focus.

Tuesday, September 06, 2005

DIY & Potatoes

DIY -- A Plate of Delicious Sliced Potatoes

Gao Mingxin

http://www.i-chinatrade.com/zgc/zuan/diy.htm

Another person has come to Zhongguancun. In the blink of a eye, he has bought a screwdriver. A few hours later, he has collected a CPU, a monitor, memory and other Zhongguancun “specialties” to take back home. This is “DIY” a newly fashionable phrase in the Village (Zhongguancun’s nickname). Put simply, DIY (“do-it-yourself”) is a three-way contest between a screwdriver, a computer case, and a monitor. “Cultured people” in the Village explain the phrase this way: “DIY is directly oriented to a large number of users. DIY assembly is the bridge between users and component sellers. DIY is the delight of component manufacturers; DIY is the scourge of complete system manufactures.”

A few days ago, the computer industry branch of the Beijing Electronics Merchant Association united with several dozen Zhongguancun brand-name computer manufacturers to present the government with a report. In the report, the licensed, brand-name manufacturers expressed outrage -- how is it that any Tom, Dick, and Harry can make computer assembly into a puzzle game? The report showed that the DIY market is in chaos: some DIY-ers are not licensed but still assemble computers at large scales. This phenomenon should be clamped down upon, the report recommended. There is no quality assurance for DIY products without licenses, and the safety of products is suspect.

Although the word DIY is of recent origin, the history of assembling computers in the Village is a long one. To learn how to eat sliced potatoes with vinegar and sugar, is it necessary to learn how to DIY potatoes? No, and yet many people who use computers start to learn about them from DIY. If a citizen wants to start work but has no abilities, he/she is not even given a chance to DIY a wooden stool in middle school crafts class. But if one’s dream is to use a computer -- starting an information revolution in the household -- one can actually use this passion to DIY computers. Part of the motivation for DIY comes from the simple fact that a portion of price goes to software makers; another portion goes to workers at the computer company. Men and women of the world prefer to grasp their pocketbooks tightly. Even if the memory strip doesn’t exactly fit in the motherboard, it is of little consequence -- take it and your screwdriver back to Zhongguancun.

In practice, those who can DIY potatoes but not computers need not worry since there are specialists in Zhongguancun’s electronics markets who DIY machines just like putting together a puzzle -- sticking together the different pieces and finishing within an hour. For the thousands of computer market counters, DIY is a Zhongguancun specialty. But the happiness of this bunch has become the worry of that bunch. The DIY business makes brand name manufacturers furrow their brows. With the appearance of licenses, brand names are more authentic and trustworthy. As the Chinese proverb foretells, “the army of the emperor will always defeat a lesser known army.” But history has shown that Li Zicheng still was able to occupy Beijing. The DIY-ers in the present component market are still riding high. “On Sunday’s, individual computer assemblers resemble a rushing stream -- they encircle the display areas of dozens of manufactures. In one day, every manufacturer has revenues over 100,000 yuan.” If everyone’s bowls were full, there would be no starving people suffering from famine. Isn’t it a good thing that everyone can enjoy DIY?

Demand has freed the market, so limiting DIY will not work. The debate over DIY does not boil down to a simple statement, nor is it a fundamental problem. DIY has real significance for the formation of the market and for rules of the market. DIY has relative standards that are based on price. Just as some people wear alligator skin shoes purchased from a store, others wear handmade vagabond shoes: it is not a question of whether or not your toes are comfortable -- price is the decisive factor. It is said that DIY products lack quality assurance. That is indisputable. Alligator skin shoes are more durable than vagabond shoes. But, as there are no DIY aircraft carriers, and no DIY B-52 bombers, there is little reason to fear.

10-20% of the U.S. computer market is personal or professional DIY assembled computers. But foreign DIY shows that red-hot demand centers on quality -- people who put a computer case together with a monitor suffer the scorn of experts. The originality of DIY comes from the pleasure of using one’s own hands in the process. If DIY creates a plate of delicious sliced potatoes but at the same time leads to conflict in the household, then losses outweigh gains.

Translated and edited by Tyler Rooker on September 6, 2005 for

http://chinasilicon.blogspot.com

Copyright help by original author

Gao Mingxin

http://www.i-chinatrade.com/zgc/zuan/diy.htm

Another person has come to Zhongguancun. In the blink of a eye, he has bought a screwdriver. A few hours later, he has collected a CPU, a monitor, memory and other Zhongguancun “specialties” to take back home. This is “DIY” a newly fashionable phrase in the Village (Zhongguancun’s nickname). Put simply, DIY (“do-it-yourself”) is a three-way contest between a screwdriver, a computer case, and a monitor. “Cultured people” in the Village explain the phrase this way: “DIY is directly oriented to a large number of users. DIY assembly is the bridge between users and component sellers. DIY is the delight of component manufacturers; DIY is the scourge of complete system manufactures.”

A few days ago, the computer industry branch of the Beijing Electronics Merchant Association united with several dozen Zhongguancun brand-name computer manufacturers to present the government with a report. In the report, the licensed, brand-name manufacturers expressed outrage -- how is it that any Tom, Dick, and Harry can make computer assembly into a puzzle game? The report showed that the DIY market is in chaos: some DIY-ers are not licensed but still assemble computers at large scales. This phenomenon should be clamped down upon, the report recommended. There is no quality assurance for DIY products without licenses, and the safety of products is suspect.

Although the word DIY is of recent origin, the history of assembling computers in the Village is a long one. To learn how to eat sliced potatoes with vinegar and sugar, is it necessary to learn how to DIY potatoes? No, and yet many people who use computers start to learn about them from DIY. If a citizen wants to start work but has no abilities, he/she is not even given a chance to DIY a wooden stool in middle school crafts class. But if one’s dream is to use a computer -- starting an information revolution in the household -- one can actually use this passion to DIY computers. Part of the motivation for DIY comes from the simple fact that a portion of price goes to software makers; another portion goes to workers at the computer company. Men and women of the world prefer to grasp their pocketbooks tightly. Even if the memory strip doesn’t exactly fit in the motherboard, it is of little consequence -- take it and your screwdriver back to Zhongguancun.

In practice, those who can DIY potatoes but not computers need not worry since there are specialists in Zhongguancun’s electronics markets who DIY machines just like putting together a puzzle -- sticking together the different pieces and finishing within an hour. For the thousands of computer market counters, DIY is a Zhongguancun specialty. But the happiness of this bunch has become the worry of that bunch. The DIY business makes brand name manufacturers furrow their brows. With the appearance of licenses, brand names are more authentic and trustworthy. As the Chinese proverb foretells, “the army of the emperor will always defeat a lesser known army.” But history has shown that Li Zicheng still was able to occupy Beijing. The DIY-ers in the present component market are still riding high. “On Sunday’s, individual computer assemblers resemble a rushing stream -- they encircle the display areas of dozens of manufactures. In one day, every manufacturer has revenues over 100,000 yuan.” If everyone’s bowls were full, there would be no starving people suffering from famine. Isn’t it a good thing that everyone can enjoy DIY?

Demand has freed the market, so limiting DIY will not work. The debate over DIY does not boil down to a simple statement, nor is it a fundamental problem. DIY has real significance for the formation of the market and for rules of the market. DIY has relative standards that are based on price. Just as some people wear alligator skin shoes purchased from a store, others wear handmade vagabond shoes: it is not a question of whether or not your toes are comfortable -- price is the decisive factor. It is said that DIY products lack quality assurance. That is indisputable. Alligator skin shoes are more durable than vagabond shoes. But, as there are no DIY aircraft carriers, and no DIY B-52 bombers, there is little reason to fear.

10-20% of the U.S. computer market is personal or professional DIY assembled computers. But foreign DIY shows that red-hot demand centers on quality -- people who put a computer case together with a monitor suffer the scorn of experts. The originality of DIY comes from the pleasure of using one’s own hands in the process. If DIY creates a plate of delicious sliced potatoes but at the same time leads to conflict in the household, then losses outweigh gains.

Translated and edited by Tyler Rooker on September 6, 2005 for

http://chinasilicon.blogspot.com

Copyright help by original author

Friday, August 26, 2005

The Value of Money

Does China have the Second-Largest GDP in the World?

According to statistics reported by the China Daily, China's gross domestic product for 2004 was in the neighborhood of 13.65 trillion yuan (or 1.65 trillion USD, with an exchange rate of 8.28 yuan per dollar). Using only the exchange rate to convert yuan to dollars, however, does not reveal the entire story. Indeed, the CIA ranks China second in the world, behind only the United States, in terms of GDP. The figure they use is 7.26 trillion USD for China's GDP.

In terms of only the exchange rate (8.28 yuan per dollar) the World Bank ranks China's economy 7th in the world at 1.65 trillion USD. The IMF ranks China sixth in terms of GDP.

But when purchasing power parity, rather than the exchange rate, is used to “compare” China's GDP to those of other countries, the situation changes. This is why the CIA ranks China second in the world. This is also true of data from the IMF (see list here).

Purchasing power (also known as PPP, or purchasing power parity) is the principle that money used domestically can be exchanged for a certain amount of goods and services. Put simply, money has a certain value. To compare the value of money, one cannot rely simply on the exchange rate. The value of 1 yuan in China, that is the amount of goods and services it will buy, can be compared to the value of 1 USD in the United States. To make this comparison, economists choose a “basket” of goods and services and then compare the price in different countries, usually using the U.S. basket as a benchmark. In theory, a vast discrepancy between exchange rate and purchasing power will lead to arbitrage, since one can simply keep buying goods at the lower price until the exchange rate equalizes. China pegging the yuan to the dollar, however, keeps the rate stable regardless of inflows of foreign dollars. (There is a good article in the April 4, 2005 Business Week on “Hot Money,” but it is available to subscribers only).

The Economist has compiled a Big Mac Index which uses the price of a Big Mac to relate the purchasing power of currencies to each other (the benchmark is a $3 U.S. hamburger, so if the same burger is cheaper in China, purchasing power is greater there). For China, they cite a figure of 3.43 as the PPP of the dollar. This would imply, using the Economist Intelligence Unit's figure of 1.68 trillion USD for China's GDP, a "Big Mac" adjusted GDP of 5.76 billion USD. That is, in terms of purchasing power, China's has a GDP of 5.76 trillion USD (FIY the Economist Intelligence Unit’s own figure for GDP in terms of purchasing power is 7.55 trillion USD, using 4.5 for its purchasing power ratio or a yuan-to-dollar rate of 1.84).

The more common figure for understanding the purchasing power of China's economy is 1.8 (from the World Bank's World Development Indicators report, listed here). Using quick and easy math, divide the exchange rate (8.28 yuan per dollar) by the purchasing power conversion factor (1.8 yuan per dollar) and you get a unit-less ratio of 4.6. What it means is that 1 USD buys 4.6 more value in China than in the United States. Converted in this way, China's GDP ranks second in the world.

I am not an economist. The above was gleaned from the web over the past week. I can only provide my experiences as a confirmation of the relevance of purchasing power to converting statistical figures that come out of China these days.

Two anecdotes

Before I went to China for the first time with University of California's Education Abroad Program in 2000, I attended an orientation hosted in Berkeley. One of the speakers, a past participant, noted that one should not argue vigorously with petty traders over a few yuan. Later, I expressed my unease with such a blanket statement. An economics undergraduate, who was giving me a ride, vehemently defended the speaker. The ride home was quite unpleasant as I stuck by my conviction that despite the fact that a couple of yuan was only a quarter or two, I did not want to give away my quarters. I also felt that such unequivocal rendering of exchange was dismissive of the context one might encounter in China.

Living in Beijing for several years since the yuan polemic, I discovered the real power of money. In Beijing, in Zhongguancun, a nice two-bedroom apartment cost me 2,400 yuan a month (about 300 USD). This was a nice area, convenient, clean, and safe. But my friends in China chided me that it was too expensive, since the apartment lacked a refrigerator. I scrimped money by eating fast food (a bowl of rice topped with one item of cuisine) for 5 yuan a meal. But herein is the evidence for purchasing parity calculations.

In China, or Beijing nonetheless, the cost of daily living is much cheaper than in equivalent cities in the U.S. Therefore, a figure such as the ratio 4.6 worked out above for multiplying China’s GDP (or other figures such as the Big Mac Index) is reasonable. An 8 yuan meal in Beijing converts via the exchange rate to a 1 USD meal. But using the purchasing power multiplier, it is really a 4.6 USD meal. That is much closer to actual experience, since I can buy rice topped with food items in San Francisco for about 4 USD. Rent, too, should be viewed this way. My two-bedroom apartment in Beijing only cost 300 USD a month. But in real purchasing power terms, it cost 300*4.6 = 1,380 USD a month. That seems to fit reality much closer, since 300 USD rents you only a storage unit in San Francisco, while 1,380 USD would get you a nice two-bedroom apartment.

Purchasing power arguments notwithstanding, the official exchange rate of 8.28 (or, now, 8.11) yuan per dollar tells us little about what a dollar or a yuan actually purchases in China. Certainly, the point can be made that Starbucks coffee in Beijing is more expensive than it is here (it costs 16 yuan or 2 USD for a cup of Starbucks coffee in Beijing). But the point is that that coffee costs more in value in China than it does in the U.S. To understand the equivalence in value, rather than in monetary, terms, one must use purchasing power. Hence that cup of Starbucks coffee really costs you 9.2 USD in terms of equivalent value forsaken to imbibe the brewed beverage. There are real reasons to vehemently bargain over “a few yuan.”

According to statistics reported by the China Daily, China's gross domestic product for 2004 was in the neighborhood of 13.65 trillion yuan (or 1.65 trillion USD, with an exchange rate of 8.28 yuan per dollar). Using only the exchange rate to convert yuan to dollars, however, does not reveal the entire story. Indeed, the CIA ranks China second in the world, behind only the United States, in terms of GDP. The figure they use is 7.26 trillion USD for China's GDP.

In terms of only the exchange rate (8.28 yuan per dollar) the World Bank ranks China's economy 7th in the world at 1.65 trillion USD. The IMF ranks China sixth in terms of GDP.

But when purchasing power parity, rather than the exchange rate, is used to “compare” China's GDP to those of other countries, the situation changes. This is why the CIA ranks China second in the world. This is also true of data from the IMF (see list here).

Purchasing power (also known as PPP, or purchasing power parity) is the principle that money used domestically can be exchanged for a certain amount of goods and services. Put simply, money has a certain value. To compare the value of money, one cannot rely simply on the exchange rate. The value of 1 yuan in China, that is the amount of goods and services it will buy, can be compared to the value of 1 USD in the United States. To make this comparison, economists choose a “basket” of goods and services and then compare the price in different countries, usually using the U.S. basket as a benchmark. In theory, a vast discrepancy between exchange rate and purchasing power will lead to arbitrage, since one can simply keep buying goods at the lower price until the exchange rate equalizes. China pegging the yuan to the dollar, however, keeps the rate stable regardless of inflows of foreign dollars. (There is a good article in the April 4, 2005 Business Week on “Hot Money,” but it is available to subscribers only).

The Economist has compiled a Big Mac Index which uses the price of a Big Mac to relate the purchasing power of currencies to each other (the benchmark is a $3 U.S. hamburger, so if the same burger is cheaper in China, purchasing power is greater there). For China, they cite a figure of 3.43 as the PPP of the dollar. This would imply, using the Economist Intelligence Unit's figure of 1.68 trillion USD for China's GDP, a "Big Mac" adjusted GDP of 5.76 billion USD. That is, in terms of purchasing power, China's has a GDP of 5.76 trillion USD (FIY the Economist Intelligence Unit’s own figure for GDP in terms of purchasing power is 7.55 trillion USD, using 4.5 for its purchasing power ratio or a yuan-to-dollar rate of 1.84).

The more common figure for understanding the purchasing power of China's economy is 1.8 (from the World Bank's World Development Indicators report, listed here). Using quick and easy math, divide the exchange rate (8.28 yuan per dollar) by the purchasing power conversion factor (1.8 yuan per dollar) and you get a unit-less ratio of 4.6. What it means is that 1 USD buys 4.6 more value in China than in the United States. Converted in this way, China's GDP ranks second in the world.

I am not an economist. The above was gleaned from the web over the past week. I can only provide my experiences as a confirmation of the relevance of purchasing power to converting statistical figures that come out of China these days.

Two anecdotes

Before I went to China for the first time with University of California's Education Abroad Program in 2000, I attended an orientation hosted in Berkeley. One of the speakers, a past participant, noted that one should not argue vigorously with petty traders over a few yuan. Later, I expressed my unease with such a blanket statement. An economics undergraduate, who was giving me a ride, vehemently defended the speaker. The ride home was quite unpleasant as I stuck by my conviction that despite the fact that a couple of yuan was only a quarter or two, I did not want to give away my quarters. I also felt that such unequivocal rendering of exchange was dismissive of the context one might encounter in China.

Living in Beijing for several years since the yuan polemic, I discovered the real power of money. In Beijing, in Zhongguancun, a nice two-bedroom apartment cost me 2,400 yuan a month (about 300 USD). This was a nice area, convenient, clean, and safe. But my friends in China chided me that it was too expensive, since the apartment lacked a refrigerator. I scrimped money by eating fast food (a bowl of rice topped with one item of cuisine) for 5 yuan a meal. But herein is the evidence for purchasing parity calculations.

In China, or Beijing nonetheless, the cost of daily living is much cheaper than in equivalent cities in the U.S. Therefore, a figure such as the ratio 4.6 worked out above for multiplying China’s GDP (or other figures such as the Big Mac Index) is reasonable. An 8 yuan meal in Beijing converts via the exchange rate to a 1 USD meal. But using the purchasing power multiplier, it is really a 4.6 USD meal. That is much closer to actual experience, since I can buy rice topped with food items in San Francisco for about 4 USD. Rent, too, should be viewed this way. My two-bedroom apartment in Beijing only cost 300 USD a month. But in real purchasing power terms, it cost 300*4.6 = 1,380 USD a month. That seems to fit reality much closer, since 300 USD rents you only a storage unit in San Francisco, while 1,380 USD would get you a nice two-bedroom apartment.

Purchasing power arguments notwithstanding, the official exchange rate of 8.28 (or, now, 8.11) yuan per dollar tells us little about what a dollar or a yuan actually purchases in China. Certainly, the point can be made that Starbucks coffee in Beijing is more expensive than it is here (it costs 16 yuan or 2 USD for a cup of Starbucks coffee in Beijing). But the point is that that coffee costs more in value in China than it does in the U.S. To understand the equivalence in value, rather than in monetary, terms, one must use purchasing power. Hence that cup of Starbucks coffee really costs you 9.2 USD in terms of equivalent value forsaken to imbibe the brewed beverage. There are real reasons to vehemently bargain over “a few yuan.”

Tuesday, August 16, 2005

What is Piracy to Microsoft?

Piracy or Monopoly?

In Zhongguancun, China's Silicon Valley, piracy of Windows XP is rampant. That is beyong dispute. From the migrants who approach you outside the major electronics markets to the DIY (do-it-yourself) computer assemblers, no one pays for Windows. The reason: cost. It costs over 2000 yuan ($250) to buy Windows. Pirated copies cost 6 yuan (three quarters). But does this subvert or sustain Microsoft's monopoly on operating systems?

"The bird who sticks out its head gets shot," goes a proverb in Chinese. The meaning, for large companies like Baidu, UFIDA, and Lenovo, is that if they use pirated software, they will be "shot" by Microsoft, in court. The fly-by-night migrant, who only make 800 yuan ($100) a month selling pirated software can be arrested, bankrupted by fines, and sent home. But what would that net Microsoft? Nothing, since the fines would go to Beijing city government police. How does piracy help Microsoft?

The answer, from one point of view, is that by continuing piracy, Microsoft is able to sustain its monopoly in China. There are no Chinese operating systems. There are none even in the works. Why? Because they will be pirated as well. Piracy undercuts Microsoft but it also undercuts would-be Chinese entrepreneurs who could (undoubtably) create a Chinese proprietary operating system that could sell for 200 yuan ($25). That is the threshold price that would keep Chinese entrepreneurs profitable and return their investment costs. But why doesn't Kingsoft, the Microsoft of China, attempt it? Piracy.

Piracy, in the case of China, does take profit from Microsoft. But I would argue that Microsoft also benefits, and even profits (as the proverb predicts) from piracy. Without piracy, 100 operating systems, like Chairman Mao's flowers, would bloom. They would undercut and eventually end Microsoft's monopoly on operating systems.

Next time Microsoft complains about piracy, make sure they point out exactly why. 4/5 of the computers in Zhongguancun are name-brand, and come with official Microsoft licenses. 1/5 are DIY, are cheaper, and come with pirated Windows. So where is profit lost with respect to profit gainined?

In Zhongguancun, China's Silicon Valley, piracy of Windows XP is rampant. That is beyong dispute. From the migrants who approach you outside the major electronics markets to the DIY (do-it-yourself) computer assemblers, no one pays for Windows. The reason: cost. It costs over 2000 yuan ($250) to buy Windows. Pirated copies cost 6 yuan (three quarters). But does this subvert or sustain Microsoft's monopoly on operating systems?

"The bird who sticks out its head gets shot," goes a proverb in Chinese. The meaning, for large companies like Baidu, UFIDA, and Lenovo, is that if they use pirated software, they will be "shot" by Microsoft, in court. The fly-by-night migrant, who only make 800 yuan ($100) a month selling pirated software can be arrested, bankrupted by fines, and sent home. But what would that net Microsoft? Nothing, since the fines would go to Beijing city government police. How does piracy help Microsoft?

The answer, from one point of view, is that by continuing piracy, Microsoft is able to sustain its monopoly in China. There are no Chinese operating systems. There are none even in the works. Why? Because they will be pirated as well. Piracy undercuts Microsoft but it also undercuts would-be Chinese entrepreneurs who could (undoubtably) create a Chinese proprietary operating system that could sell for 200 yuan ($25). That is the threshold price that would keep Chinese entrepreneurs profitable and return their investment costs. But why doesn't Kingsoft, the Microsoft of China, attempt it? Piracy.

Piracy, in the case of China, does take profit from Microsoft. But I would argue that Microsoft also benefits, and even profits (as the proverb predicts) from piracy. Without piracy, 100 operating systems, like Chairman Mao's flowers, would bloom. They would undercut and eventually end Microsoft's monopoly on operating systems.

Next time Microsoft complains about piracy, make sure they point out exactly why. 4/5 of the computers in Zhongguancun are name-brand, and come with official Microsoft licenses. 1/5 are DIY, are cheaper, and come with pirated Windows. So where is profit lost with respect to profit gainined?

Wednesday, August 10, 2005

Report on Zhongguancun

2005

The First 6 Months

Map:

graphic courtesy of The Beijing News

(see map source here)

Zhongguancun in the First Half of 2005

Translated and adapted from the original Chinese by Tyler Rooker on August 10, 2005 for Zhongguancun Blog

“Year-to-Date Income for the Zhongguancun Science & Technology Zone Surpasses 190 Billion”

(article source)

Reporter: Zheng Jinwu of Science Times (Kexue Shibao)

Original article reported on July 28, published on July 29.

Information released by the Zhongguancun Science & Technology Zone management committee revealed that, in the first half of 2005, Zhongguancun enterprises had a total income of 191 billion yuan, representing an increase of 29.6% over last year.

Exports had foreign currency profits of 3.2 billion USD, an increase of 91% over last year.

Industrial production reached a value of 104 billion yuan, an increase of 29.8% over last year.

______________________________________________________________________________

This income was structured in the following ways:

Product sales had an income of 121 billion yuan

Technology had an income of 25.0 billion yuan

If income is separated according to the different parks of the Zone, we find that:

Enterprises in the Zone during the first 6 months of this year had total profits of 4.91 billion yuan, a decrease of 9.8% from the same period last year.

OTHER STATISTICS

Software enterprises in the Haidian Park have had a total income of 10.3 billion yuan during the first five months of 2005.

System integration has earned 7.16 billion yuan during the same period.

Energy and conservation companies are rapidly expanding in the Changping Park. For example, three notable companies are

Great Wall Drilling Company (GWDC)

National Electricity Fuel Company (NEFC)

China National Logging Corporation (CNLC)

There are over 196 companies in the Zhongguancun Zone that have an income over 100 million yuan in 2005. These companies have 63.7 billion yuan in production value, have created 2.4 billion USD in export reserves, and have 6.5 billion in profit.

Already in 2005, 2,236 high-tech companies have been created.

There are currently 73 companies listed on the Shenzhen, Shanghai, Hong Kong, and NASDAQ stock exchanges that come from Zhongguancun.

The First 6 Months

Map:

graphic courtesy of The Beijing News

(see map source here)

Zhongguancun in the First Half of 2005

Translated and adapted from the original Chinese by Tyler Rooker on August 10, 2005 for Zhongguancun Blog

“Year-to-Date Income for the Zhongguancun Science & Technology Zone Surpasses 190 Billion”

(article source)

Reporter: Zheng Jinwu of Science Times (Kexue Shibao)

Original article reported on July 28, published on July 29.

Information released by the Zhongguancun Science & Technology Zone management committee revealed that, in the first half of 2005, Zhongguancun enterprises had a total income of 191 billion yuan, representing an increase of 29.6% over last year.

Exports had foreign currency profits of 3.2 billion USD, an increase of 91% over last year.

Industrial production reached a value of 104 billion yuan, an increase of 29.8% over last year.

______________________________________________________________________________

This income was structured in the following ways:

Product sales had an income of 121 billion yuan

Technology had an income of 25.0 billion yuan

If income is separated according to the different parks of the Zone, we find that:

| Name_____________ | 2005 Income_______ | Percentage of total |

| _________________ | _________________ | _____________ |

| Haidian Park | 99.9 billion yuan | 52.2% |

| Fengtai Park | 23.4 billion yuan | 12.2% |

| Changping Park | 12.5 billion yuan | 06.5% |

| Electronics City | 17.0 billion yuan | 08.9% |

| Yizhuang | 37.5 billion yuan | 19.6% |

| Desheng Park | 0.78 billion yuan | 00.4% |

| Jianxiang Park | 0.25 billion yuan | 00.1% |

Enterprises in the Zone during the first 6 months of this year had total profits of 4.91 billion yuan, a decrease of 9.8% from the same period last year.

OTHER STATISTICS

Software enterprises in the Haidian Park have had a total income of 10.3 billion yuan during the first five months of 2005.

System integration has earned 7.16 billion yuan during the same period.

Energy and conservation companies are rapidly expanding in the Changping Park. For example, three notable companies are

Great Wall Drilling Company (GWDC)

National Electricity Fuel Company (NEFC)

China National Logging Corporation (CNLC)

There are over 196 companies in the Zhongguancun Zone that have an income over 100 million yuan in 2005. These companies have 63.7 billion yuan in production value, have created 2.4 billion USD in export reserves, and have 6.5 billion in profit.

Already in 2005, 2,236 high-tech companies have been created.

There are currently 73 companies listed on the Shenzhen, Shanghai, Hong Kong, and NASDAQ stock exchanges that come from Zhongguancun.

Tuesday, August 09, 2005

Proposal for California-China Free Trade Agreement (CCFTA)

In this post, I call on the Gubernator, Governor Arnold Schwarzenegger of California, to use his trip to Beijing (November 13-18, 2005) as a stepping stone to negotiate a free-trade agreement with California. One important reason, as a review of the recent Central America Free Trade Agreement (CAFTA) shows, is that California is subsidizing socks, skirts, shirts, and other garments being produced in Alabama and North Carolina.

What is it about China?

Two articles in The Economist last week (entitles “How China runs the World Economy” and “From T-shirts to T-bonds,” both published in the print edition on July 28, 2005) give us a reasonable understanding of the relation between China, the U.S., and the world economy.

First, China: it has a massive, cheap labor force to the extent that shoes, toys, clothes, electronics, and other manufactured goods are made cheaper by being made in China. Of at least as much important, however, is the second thing about China, namely that is usually open to trade (total goods and services in export and import is equivalent to 75% of its GDP according to The Economist).

Why does this affect the U.S.? Because the yuan or renminbi (China’s currency) has been pegged to the dollar at around 8.27 yuan per USD, the more investment and export of goods and services, the more foreign (U.S.) currency China has. Since the exchange rate is supposed to remain constant, China must push the U.S. dollars it earns back out of the country (or else the yuan will rise naturally due to less dollars in the world economy). China’s central bank does this by purchasing treasury bonds from the U.S. government. As a result, money spent comes back as money loaned out, in effect, by China’s central bank.

Needless to say, if China’s bank decided to stop buying treasury bonds or even sold some off, the U.S., its banks, and its consumers would have to pay up or face high interest rates.

Revaluing the Yuan

Some politicians call for measures to penalize China since it pegs the yuan to the dollar. With a cheaper yuan, the cost of exports from China would rise, making the price of goods (shirts, socks, and televisions) more expensive and hence more competitive with manufacturers of these goods in the U.S. The U.S. does not manufacture televisions. But, apparently, it still does manufacture shirts, socks, and skirts. To protect their constituents, politicians pressure the government to pass measures to restrict competition. Not only is this unfair trade and more typical of big government interference than free-market capitalism, it ends with consumers paying more, or subsidizing, for goods that could be made cheaper elsewhere. This is a same and I call on Governor Schwarzenegger to stop it.

Note: According to an August 2, 2005 New York Times article, entitled “Bush Administration Will Ask China to Agree to Broad Limits on Clothing Exports,” the Bush administration was forced to concede to politicians from Alabama and North Carolina to pass the Central America Free Trade Agreement (CAFTA). First, in elaborate conditions, shirt pockets and skirt waistbands must be “made in America” in order to be “freely traded.” This is essentially a subsidy on clothing imports from central America, and it is endemic in this type of agreement (see a wonderful book by Pietra Rivoli entitled The Travels of a T-Shirt in the Global Economy). Second, the Bush administration promised to force quotas in China imports. This is grossly unfair competition. I hope that the mechanisms of free trade and competition can put an end to subsidies that are wasting away on shirt pocket and skirt waistband manufacturing in Alabama and North Carolina. I am sure the workers can find something better, more productive, and more competitive to do.

But as for California, it is a dynamic state. It’s GDP is high, with vast farmlands, world-class technology, and cultural resources. Why should California subsidize the workers in Alabama and North Carolina? It shouldn’t. Therefore, California should negotiate a free trade agreement with China, independent of the rest of the United States.

This would have several advantages: first, California would no longer be forced to pay higher prices for consumer goods made more cheaply in China. California’s consumers would enjoy low prices on many consumer goods, leaving them with money to invest in business, home, and well-being. Second, removing subsidies to Alabama and North Carolina would attract businesses into California. California has lost much business due to its concern with worker welfare and corporate responsibility. A free trade agreement with China would allow business to purchase unsubsidized goods and deploy resources where they are most effective.

If Alabama and North Carolina want to outlaw Target and Wal-Mart in order for their shirt, sock, and skirt factories remain subsidized, I will grant them that freedom. But I do not believe California, California business, or Californians should be forced to bear this subsidy. Negotiate a California-China Free Trade Agreement today! Make California a better, richer, and more productive place to live!

What is it about China?

Two articles in The Economist last week (entitles “How China runs the World Economy” and “From T-shirts to T-bonds,” both published in the print edition on July 28, 2005) give us a reasonable understanding of the relation between China, the U.S., and the world economy.

First, China: it has a massive, cheap labor force to the extent that shoes, toys, clothes, electronics, and other manufactured goods are made cheaper by being made in China. Of at least as much important, however, is the second thing about China, namely that is usually open to trade (total goods and services in export and import is equivalent to 75% of its GDP according to The Economist).

Why does this affect the U.S.? Because the yuan or renminbi (China’s currency) has been pegged to the dollar at around 8.27 yuan per USD, the more investment and export of goods and services, the more foreign (U.S.) currency China has. Since the exchange rate is supposed to remain constant, China must push the U.S. dollars it earns back out of the country (or else the yuan will rise naturally due to less dollars in the world economy). China’s central bank does this by purchasing treasury bonds from the U.S. government. As a result, money spent comes back as money loaned out, in effect, by China’s central bank.

Needless to say, if China’s bank decided to stop buying treasury bonds or even sold some off, the U.S., its banks, and its consumers would have to pay up or face high interest rates.

Revaluing the Yuan

Some politicians call for measures to penalize China since it pegs the yuan to the dollar. With a cheaper yuan, the cost of exports from China would rise, making the price of goods (shirts, socks, and televisions) more expensive and hence more competitive with manufacturers of these goods in the U.S. The U.S. does not manufacture televisions. But, apparently, it still does manufacture shirts, socks, and skirts. To protect their constituents, politicians pressure the government to pass measures to restrict competition. Not only is this unfair trade and more typical of big government interference than free-market capitalism, it ends with consumers paying more, or subsidizing, for goods that could be made cheaper elsewhere. This is a same and I call on Governor Schwarzenegger to stop it.

Note: According to an August 2, 2005 New York Times article, entitled “Bush Administration Will Ask China to Agree to Broad Limits on Clothing Exports,” the Bush administration was forced to concede to politicians from Alabama and North Carolina to pass the Central America Free Trade Agreement (CAFTA). First, in elaborate conditions, shirt pockets and skirt waistbands must be “made in America” in order to be “freely traded.” This is essentially a subsidy on clothing imports from central America, and it is endemic in this type of agreement (see a wonderful book by Pietra Rivoli entitled The Travels of a T-Shirt in the Global Economy). Second, the Bush administration promised to force quotas in China imports. This is grossly unfair competition. I hope that the mechanisms of free trade and competition can put an end to subsidies that are wasting away on shirt pocket and skirt waistband manufacturing in Alabama and North Carolina. I am sure the workers can find something better, more productive, and more competitive to do.

But as for California, it is a dynamic state. It’s GDP is high, with vast farmlands, world-class technology, and cultural resources. Why should California subsidize the workers in Alabama and North Carolina? It shouldn’t. Therefore, California should negotiate a free trade agreement with China, independent of the rest of the United States.

This would have several advantages: first, California would no longer be forced to pay higher prices for consumer goods made more cheaply in China. California’s consumers would enjoy low prices on many consumer goods, leaving them with money to invest in business, home, and well-being. Second, removing subsidies to Alabama and North Carolina would attract businesses into California. California has lost much business due to its concern with worker welfare and corporate responsibility. A free trade agreement with China would allow business to purchase unsubsidized goods and deploy resources where they are most effective.

If Alabama and North Carolina want to outlaw Target and Wal-Mart in order for their shirt, sock, and skirt factories remain subsidized, I will grant them that freedom. But I do not believe California, California business, or Californians should be forced to bear this subsidy. Negotiate a California-China Free Trade Agreement today! Make California a better, richer, and more productive place to live!

Wednesday, July 27, 2005

The Debate on Chinese Enterprise Acqusitions

The Contradiction of “Going Out”:

Can the “Great Leap” Buying Spree Fulfill China's Desires?

Published July 25, 2005

(Statement: This publication uses the manuscript of China News Weekly, which along with China News Agency holds copyright privileges.)

(Article Source: China News Weekly Author: Wang Chenbo)

Click Here for the webpage of the original article in Chinese from ChinaNews.com

((Translated from the Chinese by Tyler Rooker on July 27, 2005 for http://chinasilicon.blogspot.com. ))

The high-speed growth of China’s enterprises has made apparent the fact that these enterprises are using world-class production capabilities to operate within a regional market. It is almost to the point where China can no longer hold them, since the extensive growth pattern of the past has already come an end. As a result, they hope to use acquisitions to realize a “crossover” in terms of branding and technology. The next step would then be to solve the problems of a surplus of production capabilities and upgrading industries.

However, those Chinese enterprises who “go out” face a contradiction: because the problems of surplus of production capabilities and upgrading industries remain unsolved, China’s enterprises lack true competitiveness, and thus have become passive in acquisitions overseas. Moreover, although acquisitions can sometimes extend the lifecycle of their product lines, acquisitions are not sufficient to solve the basic problems of technological progress.

The only way to change in order to realize technological progress and economic growth is to form an extensive society-wide system whose base is devoted to technology. The thought process whereby “dangerous crossovers” can be avoided by relying on overseas acquisitions must be abandoned: this desperate impulse is the result of China’s enterprises being ill-prepared to make “dangerous crossovers” in terms of branding, technology, and processes. Being firm and absolute in their choice to acquire overseas businesses, can their desires be fulfilled?

Three years ago, when China entered the WTO, a popular national habit was to cry “Wolf!” Today, while this impression still lingers, U.S. and European business sectors have begun crying “China!”

“It seems to be a little like the ‘Battle of one Hundred Regiments’ from 1940. Recently, China has divulged its concentrated firepower. The U.S. and Europe cry China, and they are referring to the coming of China’s enterprises,” said Liu Erfei, China regional chairman of Merrill Lynch, in an interview with this newspaper’s correspondent.

The “Battle of one Hundred Regiments” that Mr. Liu refers to is the recent overseas acquisitions by Chinese enterprises. It began on May 1, when Lenovo acquired IBM’s global personal computer business for 1.25 billion USD. At the time some thought that this is start of large-scale overseas acquisitions by Chinese enterprises, while others demurred that this was only an isolated case.

Before the debate came to a conclusion, on June 22 (West Coast time in the U.S.) CNOOC announced that it was embarking on the single largest overseas acquisition in Chinese history--bidding 18.5 billion USD in order to acquire the U.S. oil company Unocal Corporation.

Meanwhile, almost at the same time, Haier Group also announced its bid for the third largest U.S. consumer electronics giant, Maytag Corporation.

In addition, one of the most impressive events that happened previous was that TCL Group had formed separate joint ventures both with the old European brand Thompson Company and with Alcatel Company.

“The ‘regular army’ of China’s enterprises have, one after another, crossed the ocean to make acquisitions. This shows that overseas acquisitions are not an isolated behavior by certain Chinese enterprises. Instead, this is a trend,” the national Merchants and Commercialists Acquisition Consortium secretary general and Galaxy Securities vice president Tang Shisheng said in an interview conducted by this newspaper’s correspondent.

The “Desperation” and “Impulsiveness” of being 18-years-old

The actors on this road to acquisitions--Haier, TCL, Lenovo--are all true market heroes domestically. Lenovo’s PC products have a stable 30% market share in the domestic market; Haier’s refrigerators and deep freezers, among other white goods, have been at the top of the industry for a long time; finally, TCL, despite being a latecomer to the color television and cellular phone industries, has a market share that hovers around 20%.

Along with this glory is a short-span of growth for these enterprises. “These enterprises are more like an 18- or 19-year-old boy. Their hormones are blossoming and they are very impulsive. They run around everywhere doing things no one has thought of yet,” said vice-president of Galaxy Securities, Tang Shisheng.

As for these special “boys,” “hormones” are uncontrollable. Take China’s consumer electronics industry as an example: this industry has a history of less than 20 years, yet it

In the beginning, enterprise “profit” was directly dependent on “production capabilities.” Simple technology was introduced and a low-cost labor force and enormous market demand were added creating a situation where one could sit back and watch the money roll in. According to an industry manager interviewed by this newspaper’s correspondent, as long as one could construct a high-efficiency processing factory, “fast money” could be made easily. Everything was made, and everything made money. There was no fear of not being able to dispose of goods. Many enterprises in China have become accustomed to this situation.

This led directly to the “overlapping competition” of “homogeneous products.” Soon, this group of “boys” who grew up quickly discovered that they were using world-class production capabilities to play a regional market. It is almost to the point where China can no longer accept them, since the extensive growth pattern of the past has ended quickly.

The “fast money” made in the beginning has created an accumulation of structural surplus. This can be seen from the operating rate of capacity of current consumer goods enterprises. “From 2000, if China’s consumer goods enterprises could reach 40% of operating capacity, they would thank their lucky stars,” said Ji Shupeng, a manager at the HollyHigh Investment Consulting Company.

According to Mr. Ji’s research, the surplus in production capabilities of domestic consumer goods industry has reached white-hot levels. In microwaves, for example, the yearly production capacity of the top 5 manufacturers, including Galanz and Haier, is over 30 million units. The domestic market for microwaves has a capacity of 4 million units per year, while the entire globe takes shipments of approximately 50 million units. This means that production capabilities of domestic enterprises require the entire globe in order to be absorbed. Other products, such as refrigerators, air-conditioners, and televisions, also face the same type of problem.

Another aspect of this situation is that “cut-throat competition” of homogenization in the market never stops. The price war has become a “gentle knife,” and industry stories of “destroying” competitors’ production capabilities are old news.